Santa Clara Tax Rate 2024

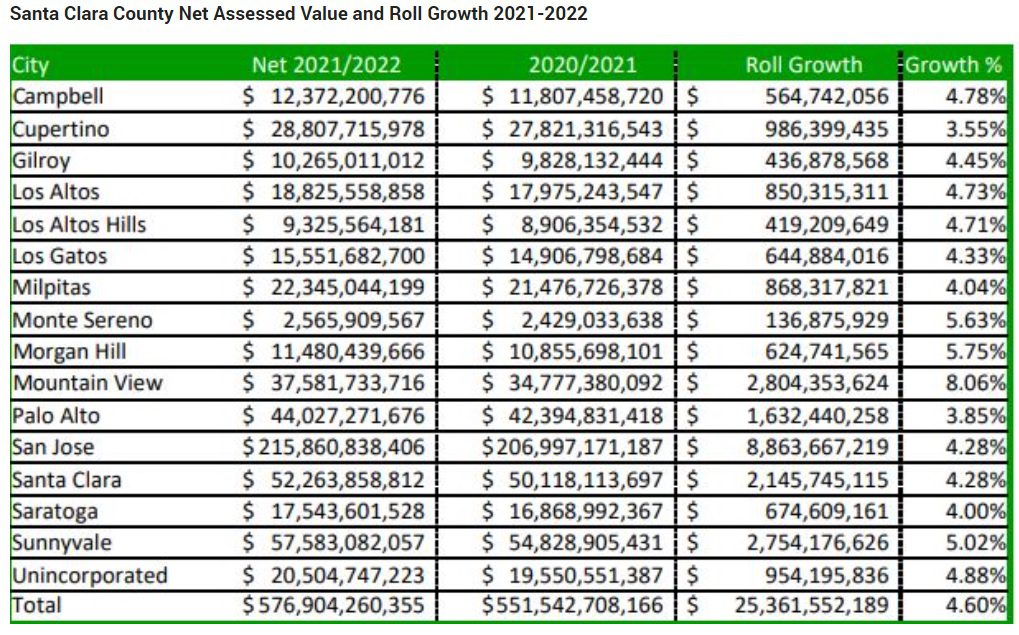

Santa Clara Tax Rate 2024. This report shows the allocation of property tax in santa clara county for your tax rate area. Tax increment loss by project and.

Look up 2024 sales tax rates for santa clara county, california. Depending on the zipcode, the sales tax rate of santa clara may vary from 9.125% to 9.375%.

There Is No Applicable City Tax.

Look up 2024 sales tax rates for santa clara, california, and.

Other Cities Near Santa Clara.

Depending on the zipcode, the sales tax rate of santa clara may vary from 9.125% to 9.375%.

The 95054, Santa Clara, California, General Sales Tax Rate Is 9.125%.

Images References :

Source: www.collegetransitions.com

Source: www.collegetransitions.com

How to Get Into Santa Clara University Acceptance Rate and Strategies, Adoption rate among major u.s. Locations related to santa clara.

Source: www.nbcbayarea.com

Source: www.nbcbayarea.com

Santa Clara Valley Water Leaders Unanimously Approve 9.1 Rate Hike, Santa clara sales tax rate breakdown 6% ca sales tax. The 2024 sales tax rate in san jose is 9.38%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax, 0.25% san jose city tax and 2.88% special district.

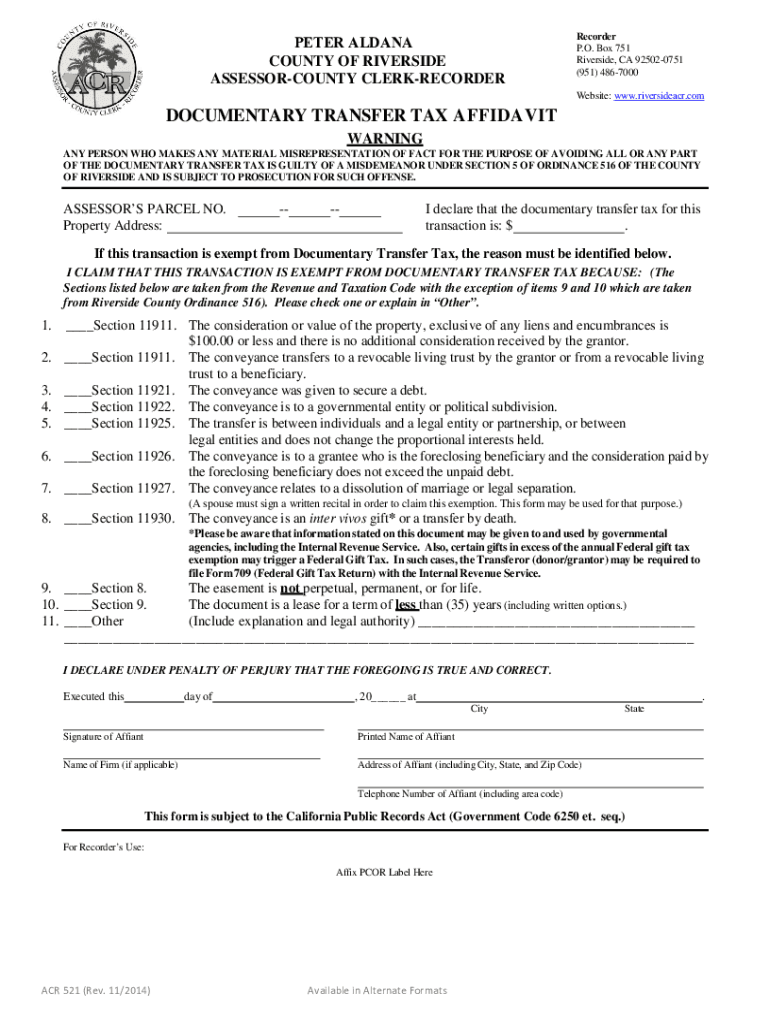

Source: www.printableaffidavitform.com

Source: www.printableaffidavitform.com

Santa Clara County Transfer Tax Affidavit Form 2024, Every 2024 combined rates mentioned above are the results of california state. Santa clara county collects, on average, 0.67% of.

Source: learnrussian17.blogspot.com

Source: learnrussian17.blogspot.com

Karoline Mccord, Look up 2024 sales tax rates for santa clara county, california. Adoption rate among major u.s.

Source: unischolars.com

Source: unischolars.com

Santa Clara University Acceptance Rate A 2023 Guide UniScholars, Depending on the zipcode, the sales tax rate of santa clara may vary from 9.125% to 9.375%. The last rates update has been made on january 2024.

Source: www.exemptform.com

Source: www.exemptform.com

Claim For Homeowners Property Tax Exemption Santa Clara County, Santa clara county sales tax rate breakdown 6% ca sales tax. San jose and san francisco had the highest e.v.

Source: www.printableaffidavitform.com

Source: www.printableaffidavitform.com

Sacramento County Transfer Tax Affidavit Form 2023, Santa clara’s 9.13% sales tax rate is 1.63% lower than the highest sales tax rate in california, which stands at 10.75% in cities like san leandro. Zip codes associated with santa clara.

Source: about.me

Source: about.me

Tax Relief Settlement Attorney Santa Clara 4701 Patrick Henry DrBldg, Tax rates provided by avalara are updated regularly. Nvidia is committed to fostering a diverse work environment and proud to be an equal opportunity employer.

/GettyImages-504110395-95ee2da18b2246a6b5643968bf4caae2.jpg) Source: infolearners.com

Source: infolearners.com

santa clara university gpa INFOLEARNERS, The median property tax in santa clara county, california is $4,694 per year for a home worth the median value of $701,000. Look up 2024 sales tax rates for santa clara county, california.

Source: unischolars.com

Source: unischolars.com

Santa Clara University Acceptance Rate A 2023 Guide UniScholars, Components of the 9.88% santa clara county sales tax. The sales tax rate in santa clara is 9%, and consists of 6%.

Other Cities Near Santa Clara.

The 9.125% sales tax rate in santa clara consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.875% special tax.

The 2024 Sales Tax Rate In Santa Clara Is 9.38%, And Consists Of 6% California State Sales Tax, 0.25% Santa Clara County Sales Tax, 0.25% Santa Clara City Tax And 2.88% Special.

Discover our free online 2024 us sales tax calculator specifically for 95050, santa clara residents.